Auctions

The $922 Million Macklowe Sale at Sotheby’s Displaces the Rockefeller Estate as the Priciest Private Art Trove in Auction History

The second chapter of the divorced couple's collection made $246.1 million, exceeding pre-sale expectations.

The second chapter of the divorced couple's collection made $246.1 million, exceeding pre-sale expectations.

The collection of divorcees Harry and Linda Macklowe is officially the most expensive private trove ever to sell at auction, garnering $922 million at Sotheby’s and surpassing the previous total notched by the Rockefeller estate in 2018.

The astonishing result was achieved after the second half of the couple’s art treasures brought in $246.1 million at Sotheby’s in New York on Monday, with every single one of the 30 lots sold. The first outing of the Macklowe collection generated $676 million in November at the same auction house, also in a white-glove sale.

This batch—which included paintings by Mark Rothko and Andy Warhol and sculptures by Pablo Picasso and Alberto Giacometti—narrowly surpassed the estimated range of $167 million to $237 million. (Final prices include auction-house fees; presale estimates do not.)

The combined total exceeded the $835.1 million raised by the Peggy and David Rockefeller collection at Christie’s four years ago. (Notably, adjusted for inflation, the Rockefeller Collection would be worth about $961.5 million in today’s dollars, still remaining the most valuable collection at auction.)

Mark Rothko, Untitled (1960). Image courtesy Sotheby’s.

“I’m just so pleased that the paintings have found a new home, it makes me very happy,” Harry Macklowe told Artnet News on his way out of the auction house and into the drizzling night where an SUV awaited. “I was at the [Burton and Emily Hall] Tremaine auction, I was at the Rockefeller auction, I was at the [Robert and Ethel] Scull auction. I never thought I’d also be at the Macklowe auction but I was, and I’m amazed.”

The Macklowe collection had been hotly anticipated by the market for years while the former spouses duked it out in court and lockdown further delayed the auction. The sale was ordered by a judge because the pair was unable to agree on valuations for the works, which they collected together over their nearly 60 years of marriage. Sotheby’s decided to split the trove across two seasons to avoid flooding the market with too many major works by the same artists all at once.

The finale of the Macklowe saga marked the start of week two of the mega-auction season, which is expected to tally more than $2 billion in sales. Sotheby’s and Phillips are taking center stage, following Christie’s $1.4 billion haul last week.

Gerhard Richter Seascape (1975). Photo: Sotheby’s.

The art market seems resilient during this auction cycle even as the financial markets are gyrating and crypto is plunging. Even the day’s torrential rain didn’t dampen the evening sale, which proceeded with efficiency if not major fireworks. With 60 percent of lots pre-sold through irrevocable bids, Sotheby’s minimized its own risk exposure after guaranteeing the collection to the warring former spouses.

Ahead of the kickoff, some wondered whether Sotheby’s would be able to retain momentum after the first sale, which had higher-priced material and the element of novelty. While this iteration had less fanfare, “it was a very solid sale,” London-based art dealer Harry Blain said. “They took a position and it paid off.”

Still, the shifts in taste were palpable, just like during last week at Christie’s. Works by erstwhile market darling Mark Grotjahn sold to their guarantors without any competition. Jean Dubuffet’s early nude Grand Nu Charbonneux (1944) also went to its guarantor for $5.4 million.

Andy Warhol, Self Portrait (1986). Image courtesy Sotheby’s.

The top lot of the night was Mark Rothko’s dark and moody Untitled (1960), which fetched $48 million, within the estimated range of $35 million to $50 million. It was purchased in 1983 from Pace gallery, whose owner, Arne Glimcher, was a friend of the couple.

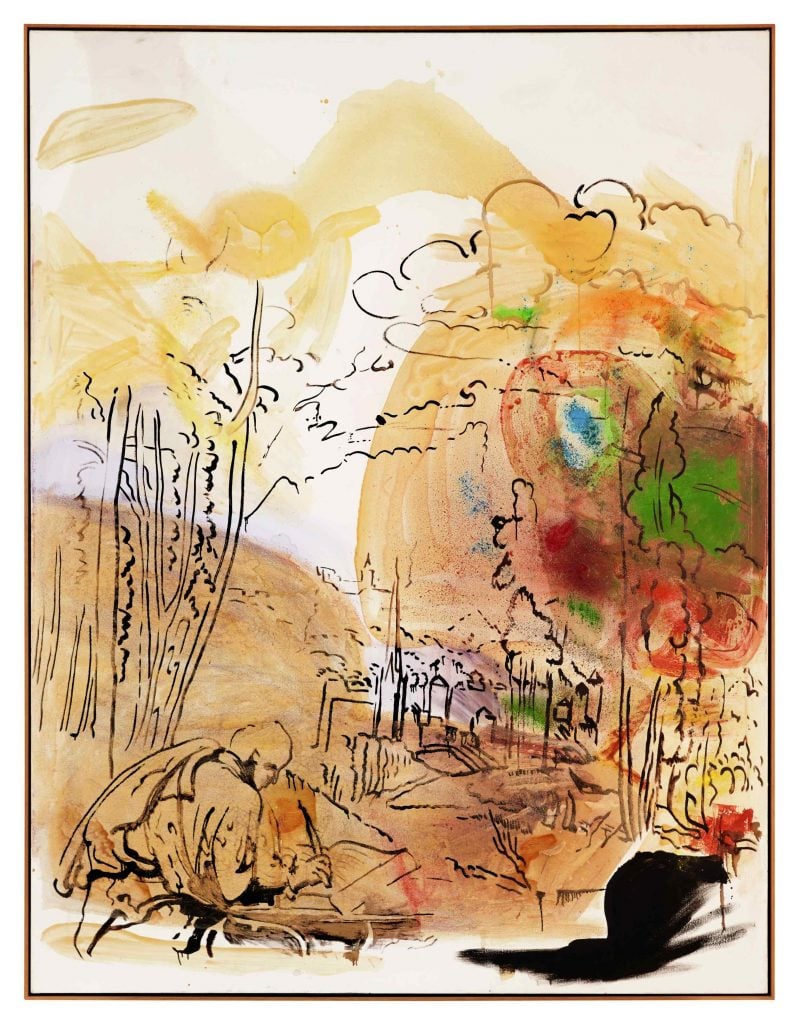

The auction included two abstract paintings by Willem de Kooning from different periods, both rich in orange tones and each estimated at $7 million to $10 million. Untitled (1961), also purchased from Pace, sold for $17.8 million, while a later work, Untitled XIII (1984), bought from Anthony d’Offay in 1987, went for $8.9 million.

Andy Warhol’s camouflage Self-Portrait (1986) was snapped up by an Asian client, Sotheby’s said, to the tune of $18.7 million, within the presale estimate.

It was a strong night for German art. Gerhard Richter’s seascape, Seestück [Seascape] (1975), fetched $30.2 million, within the estimated range of $25 million to $35 million. Two paintings by Sigmar Polke exceeded their high estimates, The Copyist selling for $6.1 million (estimate: $3 million to $4 million) and Plastik-Wannen [Plastic Tubs] for $6.2 million (estimate: $3.5 million to $4.5 million).

Sigmar Polke, The Copyist (1982). Photo: Sotheby’s.

Agnes Martin also posted a solid performance. Two paintings by the late American artist also outperformed expectations, led by the subtle blue and yellow Early Morning Happiness (2001), which fetched $9.8 million, more than twice its $3.5 million high estimate. (Martin’s auction record of $17.7 million was set during the November Macklowe sale.)

The strangest work on offer was Popples (1988), a porcelain sculpture of a popular 1980s toy by Jeff Koons, which sold for $3.9 million, almost twice the high estimate of $2 million.

Reflecting on the evening, Brooke Lampley, Sotheby’s chairman and worldwide head of sales for global fine art, said: “This was really a testament to the classics, the greats.”